Short title and commencement. Introduction The Income Tax Act 1967 ITA 1967 is the main source of reference governing the income tax system in Malaysia.

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

PERCETAKAN NASIONAL MALAYSIA BHD 2006 Act 53 INCOME TAX ACT 1967 Incorporating all amendments up to 1 January 2006 053e FM Page 1 Thursday April 6 2006 1207 PM.

. Income tax rules and legislative notifications have been reproduced or summarised in an easy-to-read table format. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia. 21st October 1971 _____ ARRANGEMENT OF SECTIONS _____.

With effect from YA 2004 foreign source income derived from sources outside Malaysia and received in Malaysia by any person is not subject to Malaysian income tax. Income Tax Act 1967. 28 September 1967 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan Rakyat in Parliament assembled and.

3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and reliable as a student text. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

INCOME TAX ACT 1967 ACT 53 SCHEDULE 6 - Exemptions From Tax. The tax exemption is stated in the Schedule 6 Paragraph 28 of the. 2 This Act shall extend throughout Malaysia.

An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith. 47 of 1967 Date of coming into operation. Business planing and co-ordination.

If that individual has income derived from Malaysia from that employment for a period or periods amounting in all to more than sixty days in the basis year referred to in that paragraph or in the period consisting of the basis years so referred to. Need to be filled. The ITA 1967 was first enacted in 1967 and frequently amended to accommodate the rapid development in Malaysian taxation.

Companies incorporated or registered under the Companies Act 2016. PREPARED FOR PUBLICATION BY MALAYAN LAW JOURNAL SDN BHD AND PRINTED BY PERCETAKAN NASIONAL MALAYSIA BERHAD. 3 This Act shall have effect for the year of assessment 1968 and.

Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 532Interpretation. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Procurement of raw materials components and finished products.

General management and administration. All classes of income under Section 4 of the Income Tax Act 1967 excluding a source of income from a partnership business in Malaysia b 根据2016年公司法令下注册或成立的公司. Section 12 of the Income Tax Act 1967 is about the determining the source of income or derivation of income.

3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. 28th September 1967 Revised up to. Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of.

1 This Act may be cited as the Income Tax Act 1967. LAWS OF MALAYSIA Act 543 PETROLEUM INCOME TAX ACT 1967 An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1.

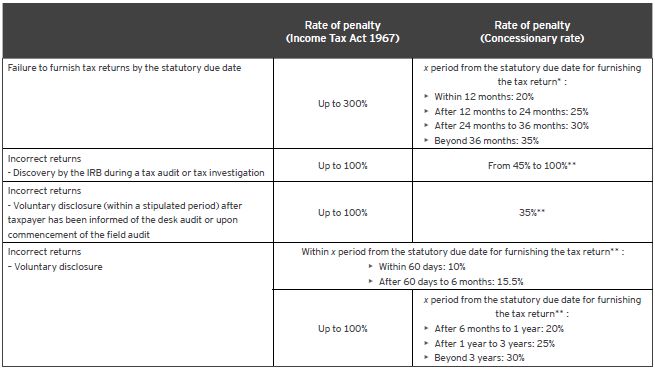

Currently the ITA 1967 contains 13 Parts with 13 Schedules and 156 Sections. The penalty listed in s1123 of the Income Tax Act 1967 is equal to three times the amount owed. Up to 3 cash back ACT 53 INCOME TAX ACT 1967 REVISED - 1971 Incorporating latest amendment - Act 6612006 First enacted.

LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. 1 This Act may be cited as the Income Tax Act 1967.

Section 140 And 140a Income Tax Act 1967 Part 2 Legally Malaysians

Individual Income Tax In Malaysia For Expats Gpa

Cpd Events Chartered Tax Institute Of Malaysia Ctim Facebook

Taxation Of Foreign Source Income In Malaysia International Tax Review

Crowe Chat Tax Vol 1 2022 Crowe Malaysia Plt

Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment Core

How The Finance Bill 2021 Affects Your Commission

Foreign Income Tax Malaysia Removal Of Exemptions

Malaysia Income Tax Act 1967 With Complete Regulations And Rules 9th Edition Taxation New Releases

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 1967 With Complete Regulations And Rules 10th Edition

Malaysia Malaysian Tax Enforcement In 2020 Updates Bdo

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment

How Much Does It Cost To Develop A Law Firm Mobile App Development App Development Mobile App Development Happy Students

Buy Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 10th April 2022 Law Books Malaysia Joshua Legal Art Gallery